ASF being contained in Vietnam

To date, 44 of 63 provinces have gone more than 30 days without an African Swine Fever (ASF) case, leading MARD to declare the ASF epidemic over in those provinces.

Vietnam first detected ASF in early 2019, with the disease spreading to all 63 provinces throughout the year. By December 2019, over 5.9m pigs were culled, accounting for about 23% of the entire swine herd.

Since the start of 2020, only 24 ASF outbreaks have officially been reported in Vietnam, leading to the death and culling of 20,177 pigs. Specifically, in January, there were 12,037 pigs culled, in February, 7,435 culled pigs, and in March, MARD estimated less than 4,000 pigs culled.

While the speed of the ASF spread and the pace of the herd decline have appeared to slow down, concerns remain over the risks of ASF outbreaks and hog price hikes, noted a USDA report.

Industry sources stated that the number of sows in the country decreased by 35-45% in 2019, and the sow population is currently around 2.7m heads. The great-grandparent pig population is about 109,000 heads, which were unaffected by ASF.

Due to the economic losses from the ASF epidemic, small-scale pig-raising households have run out of financial resources to restock their herds, found the USDA.

The price of breeder pigs has doubled or even tripled from the price in the pre-ASF period, ranging from VND 2.5m (US$106) to VND 3m.

Efforts to rebuild the pig herd are still ongoing but mainly driven by large-scale livestock firms as the sow numbers remain limited, said the US agency.

As of March 10, the total pig population was at nearly 24 million heads.

MARD forecasts the average growth rate of the value of Vietnam’s livestock production in 2020 at 4%. With meat output at about 5.8m tons - a 16.3% increase on 2019 - of which pork output could reach 3.95m tons, MARD is forecasting that pork supply will recover by the third quarter of 2020.

However, based on the sow numbers and the livestock production growth, the Vietnam General Statistics Office (GSO) has recently estimated that there would be a potential shortage of about 100,000 tons of pork in Q2 and about 30,000 tons of pork in Q3.

And there are concerns that COVID-19 containment efforts could result in depletion of human and financial resources for ASF-affected pig farmers, a slowdown in herd restocking, and disruptions to the ivestock movement, transport, distribution, and trade, which might further stall a hoped-for recovery for the pig industry, wrote the USDA.

Global spread of ASF

Indonesia was the most recent country to declare ASF detections, doing so in December 2019, making it the 11th country in Asia to be hit by the virus; additional ASF outbreaks were reported in the Philippines; there have also been recent outbreaks reported in western Poland, close to Germany. Poland and Germany are two of the Europe’s major pork exporters to Vietnam, noted the USDA.

Pork imports

Due to widespread ASF outbreaks and the recent COVID-19 pandemic, sourcing pork supply is challenging as many countries have been suspending trade, imposing movement restrictions and lockdowns, leading to disruptions in trade flows, supply chains, and distributions. Therefore, MARD recommended MOIT and the Ministry of Foreign Affairs (MFA) assist businesses in identifying reasonable pork supply sources in exporting countries, reported the USDA.

US exports of pork to Vietnam in 2019 were down to 13,788 tons (a 7% decline YOY), valued at nearly US$18.5m. One of the major constraints for US pork exports to Vietnam is the high tariffs.

The USDA noted that a MARD official was recently quoted by the local media saying that, in the context of the widespread Covid-19 pandemic, it had requested that Vietnam’s ministry of finance (MOF) consider adopting import tariff reductions for pork, including tariff reductions and exemptions for businesses importing pork from the US

MOF has proposed tariff reductions for fresh or chilled pork from 25% to 22% - the proposal is still waiting for the Prime Minister’s approval, it added.

In 2019, the EU continued to be Vietnam’s leading pork supplier, with export volume up more than 18% YOY. On June 30, 2019, Vietnam and the EU signed a free trade agreement (EVFTA) that will lead to the EU’s frozen pork and fresh/chilled pork exports becoming duty-free within seven years and nine years of entry in force respectively. The agreement is expected to be ratified by Vietnam in May 2020 and enter into force soon after. Analysts forecast that imports of pork and pork products from Europe may rise further once the EVFTA is ratified and implemented.

Switch to other animal protein sectors

As a result of ASF, some pig farmers switched to poultry and fisheries production, reported the US agency.

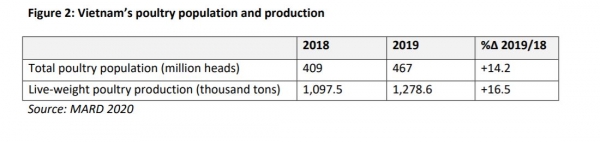

It said that considerable growth has been seen in other animal protein sectors such as beef production and fisheries production and, notably, the poultry production sector witnessed a booming growth rate of 16.5%, which led to a record high poultry population of nearly 500 million birds.

In 2018, the shares of pork and poultry in meat production were 71.5% and 20.6% respectively in Vietnam. In 2019, the shares shifted to 65.6% and 25.5% respectively.