Ecuador and Latin America to continue to drive farmed shrimp supply in 2023

“With a perfect climate, a low-intensity model and large, vertically integrated farmers, the Ecuadorian industry has a unique advantage that will last for the foreseeable future,” noted the analysts.

Shrimp supply is strong despite lower prices and higher costs, they reported.

“As with salmon, shrimp also enjoyed a strong post-pandemic period, with both good retail and recovering foodservice demand. In 2021, despite the record supply growth, high prices were maintained. However, in 2022, demand started to cool as consumers reduced foodservice spending and opted for cheaper options at retail. The lower prices levels, high feed costs and biological challenges resulted in contracting supply in Asia, especially among the largest producers, India, and China.”

Forecasting shrimp supply is very difficult, as it has a short cycle and an elastic supply curve, said the Rabobank team.

However, they noted that GSA/GOAL survey respondents were positive about production expectations for 2023, anticipating growth of 7%. “In part, this is based on the likely continuation of supply growth from Ecuador and other Latin American producers, which are profitable even at current prices and feed costs, making them incentivized and able to increase supply.”

In addition, they believe China will see production recover from 2022 levels, as both the local supply and demand for shrimp look set to improve. “The flooding that occurred in key shrimp-growing regions in southern China in 2022 will hopefully not repeat in 2023, and the strict Covid-19 restrictions that reduced demand are also likely to be lifted at some point, once again boosting Chinese demand for shrimp.”

Salmon market

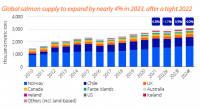

In evaluating the prospects for the global salmon market, the Rabobank report noted weak supply this year, particularly in the first six months of 2022. The reduction in supply coincided with strong demand, causing new price records.

More normal supply, as well as some demand weakness due to recessionary behavior among some consumers, has characterized the second half of the year, and caused prices to correct. “Nevertheless, prices have remained well above pre-pandemic levels.”

In 2023, the analysts predict that supply will likely be in a more normal range. Both Norway and Chile have limited growth options with existing licenses and thus need new technology to create incremental supply hikes, they argued. “Consequently, the expectation for 2023 as well as for 2024 is supply growth close to 4%.”

Investment plans shelved

The Norwegian government proposed a new resource tax in 2022, which if implemented, would effectively add an extra 40% tax on top of the existing 22% corporate tax rate paid by salmon farmers. “While this proposal could well be altered before being introduced in the Norwegian parliament in January 2023, it has already caused nearly all major investment plans by the large Norwegian players to be postponed.”

If the legislation does become a reality, Rabobank warns it would have a long-term negative effect on growth and innovation in the salmon industry.

Fishmeal prices

The high prices of competing commodities - proteins, and especially the oils - mean fishmeal and fish oil have seen ongoing price support, despite the fact the supplies of the marine raw materials have been stable in 2022.

Fishmeal prices this year reached US$1,600 per metric ton (FOB Peru), well above recent levels, while fish oil prices surpassed the US$3,000 per metric ton mark for the first time and reached levels virtually double those of late 2020 and early 2021, according to the outlook.

The Peruvian ministry for produce announced a 2.283m metric ton quota for the winter season – December to March. This is a 11.5% increase on last winter’s quota, when a 100% quota utilization was achieved, said the analysts. Therefore, fishing will need to be good for supply to improve, they stressed. In addition, improving quotas in Europe contribute to a positive supply outlook.

However, with soybean meal and soy oil prices having reached a peak in 1H 2022 and now starting to ease, Rabobank expects this development to also influence fishmeal and fish oil prices. “This price correction should not be overstated, however, as terrestrial feed commodities remain in tight supply and high prices are only marginally declining.”