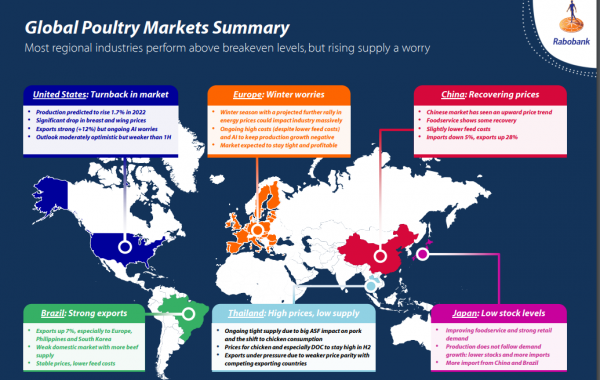

Rabobank expects decline in poultry feed price, but AI concerns remain

For the next half year, the biggest challenge for poultry producers will be on the operational side, according to the latest poultry quarterly from Rabobank.

Prices for feed are expected to stay high, although slightly below their Q2 2022 peak levels. They should move to around Q1 levels for the remainder of 2022 and early 2023, which is 10%-15% below the Q2 peak level, said the analysts.

“Feed prices are expected to ease on the relatively strong corn and soybean crops from Brazil that have been flowing into the market since June, and the good wheat and soybean crops expected for the US.”

But the publication noted slower demand for animal nutrition products, especially due to the impact of COVID-19 and a weaker economy in China, among other factors.

The rise in energy prices, especially in Europe, will be an issue for poultry producers. This could affect farming and processing, with concerns about CO2 availability for gas stunning, and higher cold storage and distribution costs, said the analysts.

“The impact of higher energy prices will differ between countries, companies, and technologies. Other factors, like labor and distribution costs, will also stay high and especially challenge companies active in trade.”

AI threat

Avian influenza (AI) is another area of uncertainty.

“AI remains a big challenge for the global industry. AI outbreaks kept occurring during the summer in Europe, the US, Canada, and Mexico. This is very unusual, as cases tended to exclusively occur in winter. It is a sign that the virus has become more endemic and will require a dedicated approach from producers.

“AI affects the trade of meat from infected regions/countries, but even more important from a global perspective is that the trade in hatching eggs and DOCs [day old chicken] at GPS [grandparent stock] and PS [parent stock] levels is restricted. This will impact production in the medium term. China for example hasn’t imported GP for several months, and if this situation continues it will likely lead to productivity losses over the next year or two. Challenges also exist in many other countries, including Africa and Latin America.”

The big winners in global trade in Q2 2022 have been the US and Brazil, which saw growth of 12% and 8%, respectively during the period. “Strong exports from the US have been a great achievement given the elevated US dollar, and rising avian influenza (AI) cases,” said the analysts.

From a market perspective, a weaker economic climate with pressure on spending power will lead to more price-driven consumer behavior, which supports poultry consumption as it is the cheapest meat protein option.