Decline expected in EU industrial feed output for 2019

FEFAC expects a moderate 0.9% dip in compound feed output this year compared to 2018. It flagged up the African swine fever and avian influenza outbreaks, as well as a potential no-deal Brexit as factors that could alter feed demand and, as a result, the accuracy of its forecasting.

Demand for cattle feed in the EU in 2019 could drop by 2%, said the EU Feed Manufacturer’s Federation (FEFAC), with the rationale behind that prediction the existing restrictions on phosphorous emissions in certain European countries and expectations of normal forage growing conditions.

In terms of the pig sector, it expects a marginal decrease in pig feed demand in Europe this year – a reduction of 0.5% - due to the sow culling that has taken place in H1 2019 arising out of pressure from welfare standards imposed on farmers in some European countries.

EU poultry feed demand in 2019 is dependent on a number of factors including the capacity of Brazil to recover its leading position on the global market. If the EU can maintain its export levels as well as relying on growing internal consumption, FEFAC said it anticipates a 0.5% hike in poultry feed.

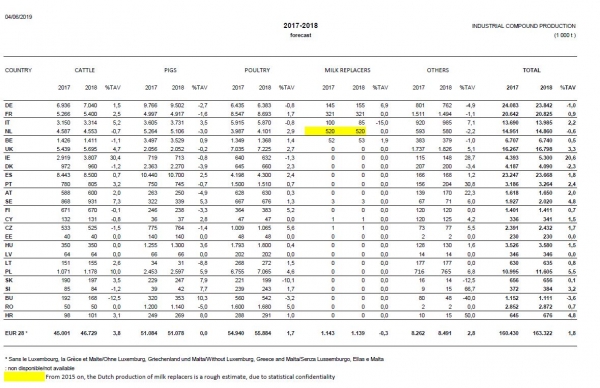

EU feed production data for 2018

Figures released by European Feed Manufacturers’ Federation (FEFAC) showed, though, compound feed production in the EU rose by 1.8% in 2018, compared to 2017, to reach 163.3m tons.

The demand for cattle feed in 2018 was 3.8% higher than in 2017, boosted by adverse weather conditions. There were exceptional drought and heatwaves, in particular during late spring/summer in North-Western Europe, which severely affected forage production, leading to a significant, but not dramatic, increase in the compound feed demand in certain regions.

“The effect became more visible at the end of winter 2019 when forage stocks reached their lowest point.”

However, farmers in certain countries, such as the Netherlands, also culled cattle, which, together with heat stress, lowered milk production but also the feed demand.

EU poultry feed production remained the leading segment of EU industrial compound feed production, well ahead of pig feed, in 2018.

The upward trend in poultry exports and sharp reduction of imports from Brazil contributed to support a positive momentum for the EU poultry sector and, therefore, an increased demand for commercial feed, said FEFAC.

Production of poultry feed last year increased by 1.7%, mostly driven by the development of poultry production in Finland, Czech Republic and Poland. Though, demand for layer feed dropped dramatically in Germany – by 4%. In France, the positive result, +1.7%, was largely linked to recovery of the duck feed market after a sharp decrease over the last two years due to Avian Influenza restrictions, said FEFAC.

On the pig feed side, production remained stable in 2018, although Spain set another production record, at 10.7m tons; several Central European countries - Hungary, Poland, Slovakia, Bulgaria, and Croatia – saw growth in pig feed demand, by 3.5% and higher, added the trade group. In contrast, North Western European countries including the Netherlands, France, and Denmark, saw their production of pig feed fall by 2 to 3%.

Poland continues stellar rise

For the fifth year in a row, Poland was the best performing country, with annual growth of total compound feed production of +5.5%, boosted equally by the demand for poultry, pig and dairy feed.

Among the largest compound feed producing countries, France and Italy maintained their production, whereas the Netherlands and Germany recorded a drop of around -0.5%/-1.8% in their total feed output.

Spain increased its production by 1.8%, while the UK saw an increase of almost 4%.

Germany maintained its position as leading EU country in terms of total compound feed production, just ahead of Spain followed by France.