USDA stocks report brings bearish corn surprise

The US Department of Agriculture (USDA) released information about US grain stores and feed crop planting intentions in a series of reports on Friday [March 29].

Looking at both the stocks report and prospective planting, it is unclear when feed crop prices might increase, said Scott Irwin, professor and Laurence J. Norton Chair of agricultural marketing, department of agricultural and consumer economics at the University of Illinois.

He was speaking in a webinar with Todd Hubbs, assistant professor at the University of Illinois, analyzing the reports.

“The USDA reported stocks of 8.605bn bushels on March 1, 2019 and that is well below last year and also below 2017/18,” he said. “The problem is that it’s not nearly as low as what the market was expecting and what had been baked into corn prices.”

The anticipation before the report’s release was that there would be about 8.335bn bushels in storage not 8.6bn bushels, he said. “So we had kind of a humdinger of a surprise going into the stocks report today,” he added.

The difference between what was expected and the actual report results was one of the larger “surprises” in recent years, he added.

“If you thought the numbers were a little bit foreboding on corn, then we turn to the March 1 soybean stocks,” said Irwin.

The amount of soybeans in storage were much closer to what was anticipated but still higher than would have been predictable in past years, he added.

Soy stats

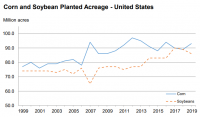

In 2019, planted area for soybeans is anticipated to drop 5% to about 84.6m acres, the USDA said. Plantings are predicted to be flat or down in 26 of the 29 states that plant soybeans.

Overall, the amount of soybeans in storage increased to 2.72bn bushels – up about 29% from this time last year, the USDA said. Soybeans in on-farm storage are estimated to be 1.27bn bushels, while those held in off-farm sites increased 15% to 1.45bn bushels.

Disappearance during the December 2018 to February 2019 period was about 1.03bn bushels, a drop of 2% from the previous year, the department said.

“We are at 2.716bn bushels [and] the market was pretty much on par with that,” said Irwin. “The bearish surprise on the stocks estimate was 33m bushels – not very big.”

The anticipation is that the amount of soybean crush could weaken going forward and there continues to be weakness in soybean exports, he said.

Although rumors continue regarding a potential trade deal between the US and China, even if it were to happen in the next few weeks it might not translate into exports for the 2018/19 marketing year.

Corn conundrums

US acres planted in corn in the upcoming 2019 growing season are forecast to reach about 92.8m acres, an increase of 4% or 3.66m acres from the previous year, the USDA said. Planted acreage is anticipated to stay the same or grow in 34 states.

Corn stocks dropped 3% from the amount in storage in March 2018, the USDA reported. The amount being held reached 8.6bn bushels.

Corn in on-farm storage increased 3% to 5.13bn bushels, and off-farm stocks dropped 11% to 3.47bn bushels, the department said. Disappearance during the December 2018 to February 2019 period was 3.33bn bushels, slightly below the pace set the previous year.

“It’s a big bearish surprise in terms of the usage of corn, there’s no way to put a happy face on that,” said Irwin. Weakness in feed and residual usage of corn has been demonstrated in the March 1 report for the last several years, he added.

“Directionally what this means is that everyone, the USDA and the market, has been overestimating usage in the first half of the marketing year for the last five years,” he said. “That’s a pretty sobering perspective.”

“If we take the March 1 stocks number literally than we have a shockingly low implied feed and residual use for the first half of the 2018/19 marketing year,” he said. However, there is some flexibility in what might have influenced that result, he added.

“What it means is that people have been putting cattle, and pigs and chickens on a diet,” he said. Alternatively, it could mean that a yield drop reported by the USDA earlier this year may not have been completely accurate or that both are partially correct.

Wheat and sorghum

Wheat planting in 2019 is expected to be down about 4% from the previous year, the USDA said. The predicted 45.8m acres is the smallest area since the department started keeping planting records.

Of the area planted, about 31.5m acres is set to be winter wheat, 12.8 is attributed to spring wheat and 1.42m acres in durum wheat, the department said.

Anticipated sorghum planted acres also fell dropping to about 5,135 from 5,690 last year, the department said.

Wheat stocks in storage on March 1 increased 6% to reach 1.59bn bushels, the USDA reported. Similarly, sorghum stocks rose 37% to 193m bushels.

However, oat stocks fell 9% from the previous year to 50.2m bushels, with the majority being stored off-farm, the department said. Barley amounts also fell – down about 7% from the previous year – to 121m bushels.

The December to February disappearance of wheat, barley and oats increased compared to previous years, the department said. But sorghum use levels during the time period dropped.