German retailer puts algal oil fed salmon on shelves

“The algal oil-fed salmon meets the increasing sense of responsibility for conscious consumption of resources,” said Andreas Schopper, head of purchasing, Kaufland.

The fish in question in being produced by Norwegian salmon farmer, Lingalaks, a farming company rearing Atlantic salmon under in the Hardanger Fjord and Northern part of Hordaland. Since October last year, it has been covering 50% of its salmon production with a feed formulation produced by Nutreco’s fish feed manufacturing arm, Skretting, that includes algal oil produced by a joint venture of DSM and Evonik.

Last January saw those two feed additive suppliers formally establish a new company, Veramaris, for the production of algal oil with high eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) content from algae. They had announced their intention to start the joint venture in March 2017.

The overall target for the algal oil is animal nutrition, but with an immediate focus on farmed salmon and pet food. The product is marketed as an alternative to fish oil from wild-caught fish, a finite resource.

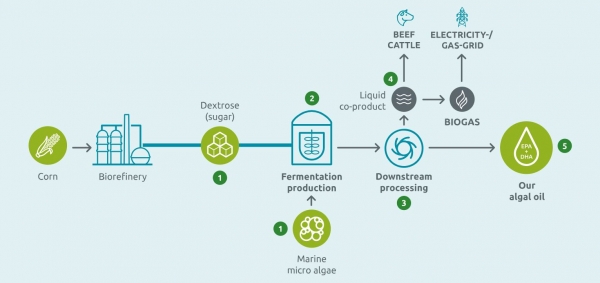

Algal oil production

The launch of this algal oil fed salmon range is a result of multi-stakeholder dialogue with partners from across the entire seafood value chain from feed manufacturers to NGOs, said Veramaris.

Karim Kurmaly, CEO of that joint venture, speaking last June, said the algal oil is the response to the industry’s call for a sustainable source of EPA and DHA, and that the known provenance of all the raw materials used in its process makes the product fully traceable.

Production of the algal oil takes place at Veramaris’s US facility in Blair, Nebraska, in the heart of the US corn belt. In terms of the initial capacity of that plant, last year the company said it was aiming to meet around 15% of the total current annual demand for EPA and DHA by the global salmon aquaculture industry.

Veramaris uses sugar in its fermentation process. The sugar is dextrose obtained from locally sourced corn.

The Blair facility is a “backward integrated site,” a DSM spokesperson told us last year. It was built to allow for large-scale fermentation for concentrated algal oil.

“We expect the supply of raw materials needed for producing the omega-3 source to be excellent and reliable thanks to the adjacent site of Cargill with whom there is a long-established partnership.

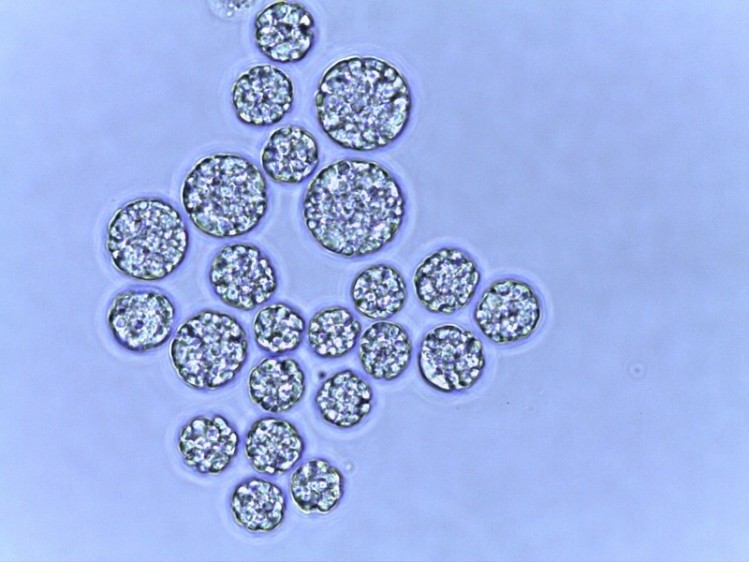

“The strain we use, Schizochytrium, is a heterotrophic organism producing both omega-3-fatty acids EPA and DHA. It is particularly suitable for large-scale fermentation processes, as it does not depend on sunlight.”

The companies said that the product is the first liquid, non-fish based source of omega-3 fatty acids, EPA and DHA, and that it offers a high concentration of active ingredients – comprising more than 50% of the product.

Mads Martinsen, director, product development, Skretting Norway, said in a release today, that replacing fish oil in salmon feed formulations is not as simple as just substitution, and it has taken years to achieve this feed breakthrough.

Competing oils

The Veramaris product is not the only commercially available fish oil-replacement product on the market.

Chilean salmon producer, Ventisqueros, is using a salmon feed developed by Danish feed producer, BioMar, which includes another fish oil-replacement product, AlgaPrime DHA.

AlgaPrime DHA, a product now solely owned by Corbion, is produced at a facility in Brazil. In April last year, Corbion acquired Bunge’s 49.9% stake in SB Renewable Oils, a joint venture that operated that Brazilian factory.

Norwegian salmon producer, Lerøy, is also reducing its use of marine sourced omega-3 fatty acids by switching to a BioMar produced feed incorporating the Corbion ingredient. A spokesperson for the Norwegian seafood company told us, in April 2017, that it had decreased the quantities of fish oil used in its salmon production by 15 to 20% as a result.

BioMar took the lead in in developing and testing feed with that microalgae derived oil product.

Meanwhile, Archer Daniels Midland (ADM) launched a 'DHA rich' alternative to the fish oil derived fatty acid in 2016 – DHA Natur.

The algae biomass needed to produce that product is being generated through a heterotrophic fermentation process at the company’s facility in Clinton, Iowa.

“Our ability to ferment and our ability to move product throughout the world means we can scale and compete with anyone else. Where the model may not work for others, it will for us," said Andrew Carlson, vice president of global feed additives and ingredients, ADM, when we spoke to him at the Hannover based trade show, EuroTier, late last year.

Long term potential of algae oil for animal nutrition

Despite the growing number of competitors in the market, Alltech, nevertheless, has wound up its omega-3 algae production in Kentucky.

We heard from Patrick Charlton, VP, Alltech Europe and CEO of the group’s specialist aqua feeds business, Coppens, about the reasons for the closure at Aqua 2018 in Montpellier, in August last year.

Alltech originally bought the facility in 2010 from Martek BioSciences and officially opened it in April 2011. It shut down the facility in January 2018.

Charlton explained the company's move:

“Alltech has not exited [the] algae [business]. What we have done is taken a position on one factory. When we bought that factory, it had a history of producing algae for Martek for the human side, and it had a very good pilot plant within it for developing algae production. After we bought it, our group there advanced the technology in terms of the levels of DHA in the algae – we increased those by between 30 and 50% - and [boosted] the fat content in the algae. But there is an inherent cost of producing algae; the cost is currently about three times the price of DHA from fish oil."

He acknowledged that there is huge industry demand for alternatives to marine ingredients to meet sustainability objectives. “However, they won’t pay for it.”

“There are other players but if you look at market price [for algae derived DHA] today, it is still bouncing around from anywhere between $10 and $20 a kilo, which really puts it into the specialty ingredients area. It is a long way off being a low-cost alternative to fish oil. Part of the reason for that is that fish oil is also delivering a number of other benefits to the diet including energy and palatability. It is not just a case of replacing the DHA, it is a case of replacing all the other things when you take the fish oil out.”