Ongoing shortage of feed in eastern Australia, USDA predicts lower wheat exports

The harvest area is expected to fall to 10 million hectares (ha) for the year, down 18% on the previous year. Western Australia (WA) is expected to account for more than 50% of the country’s wheat harvest, noted the US agency in a recent GAIN report.

"Wheat and barley production in eastern Australia declined sharply as a result of drier conditions. On the other side of the country, favorable seasonal conditions in Western Australia resulted in increased wheat and barley production as well as improved yields."

The US organization said the outlook for summer crops has slightly improved in part because of decent rainfall in December.

"The Australian Bureau of Meteorology is also forecasting average rainfall until March 2019. Still, many cropping areas are experiencing low soil moisture levels."

Feed grain shortages

An estimated 5.5 MMT of the total 2018/19 wheat crop is expected to be used for livestock feed, according to the report.

Wheat consumption is forecast at 9 MMT for 2018/19 due to higher prices for domestic feed grain and hay in eastern Australia. Human consumption of wheat is expected to remain stable at 3.5 MMT.

In eastern Australia, a higher proportion of the east coast wheat harvest of around 7 MMT will be used as livestock feed because of poor pasture growth during the drought, forecasts the USDA.

Grain prices reached near decade-highs in early 2018 on Australia’s east coast, although they have moderated recently as the region received decent rainfall in December, wrote the US agency.

“Feed grain shortages still exist in northern New South Wales (NSW) and southern Queensland resulting in grain being transported from WA to meet animal feed demand.

“High domestic feed prices in eastern Australia will limit wheat exports from this region, while the good growing conditions are likely to increase WA’s share of Australia’s total wheat exports to 60% from 40%.”

Drought conditions in eastern Australia, where soil moisture is low and pasture growth is poor, have contributed to shortage of animal feed, as per the report. Currently, all of NSW, two thirds of Queensland, parts of Victoria, and all of South Australia are experiencing drought conditions, said the US market specialists.

Wheat exports

Higher domestic feed prices in eastern Australia will further encourage intra-state trade in wheat and reduce exports, said the USDA.

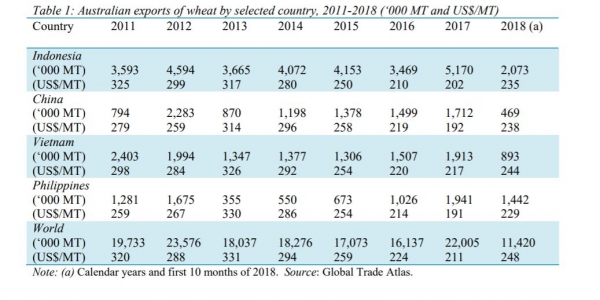

Australian wheat exports are expected to decline to 10.5 MMT in 2018/2019 due to drought and higher animal feed consumption, said the USDA. In the first 10 months of 2018, Australian wheat exports fell to 11.4 MMT, well below last year’s level, added the US agency.

Wheat exports from WA are expected to account for around 60% of total exports.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (TPP‐ 11) entered into force on December 30, 2018 for Australia, Canada, Japan, Mexico, New Zealand and Singapore. Brunei, Chile, Malaysia, Peru and Vietnam. “Under this agreement, Australian wheat exports are expected to eventually benefit from greater market access, especially from increased access into Japan.”

Barley production

The US agency predicts barley production in Australia for 2018/19 at 7.3 MMT, given that hot and dry conditions reduced yields in most states except for Western Australia.

It said drought and low soil moisture across eastern Australia during late autumn and early winter limited planting opportunities. Western Australia normally accounts for one third of barley production, but it is expected to exceed 50% in 2018/19 because of the poor climatic conditions in eastern Australia.

Overall, the harvested area is forecast to be 3.7 million ha, slightly below the official forecast of 3.8 million ha. Domestic consumption of barley is forecast at 2.9 MMT in 2018/19, 11.5% above the official forecast, as a result of the continuing drought in eastern Australia.

High domestic prices for feed barley are expected to reduce exports. Some feed barley has been transported from Western Australia to meet the shortage in eastern Australia. Barley supplies are expected to decline to below 0.5 MMT as stocks are released to meet domestic demand.

Over one third of Australia’ barley production is usually consumed domestically for food and beer production, animal feed, and seed cultivation. The remainder is exported for food and beverage production as well as animal feed.

Currently, producers and traders are obtaining better returns on the sale of feed barley in the domestic market compared to exports.

China still leading export market for Aussie barley

The US organization puts Australian barley exports at 5.4 MMT in 2018/19.

China remains the leading export destination for barley followed by Japan and Saudi Arabia, according to the USDA’s data.

“Over the past five years, the Chinese market has grown and now accounts for almost 70% of Australia’s total exports. However, exports to China could be significantly affected by an ongoing anti-dumping investigation. Chinese officials are currently investigating claims that imported Australian barley between October 2017 and September 2018 were sold below the cost of production. A positive finding could lead to anti-dumping duties, which would reduce the outlook for Australia’s barley exports in the Chinese market.”

Sorghum statistics

Sorghum production in 2018/19 is forecast at 2.2 MMT with the harvest area expected to increase to 750,000 ha.

“Decent rainfall across southern Queensland and northern NSW in late 2018 significantly increased sorghum planting. Despite the expanded planting area, prospects for the sorghum crop depend heavily on continued rainfall until May. The shortage of pasture, hay, and grain in drought affected regions incentivized farmers to plant sorghum as a result of higher animal feed prices.”

Sorghum has traditionally been used domestically for feed grain in the beef, dairy, swine, and poultry industries in Australia. Around 0.2 MMT of sorghum is processed into biofuel in Queensland.

The USDA forecasts Australian sorghum exports at 1.4 MMT in 2018/19.

“The amount of rainfall during the growing season will heavily influence total production and the volume of exports. There is also uncertainty about exports as prices for feed grains in northern NSW and southern Queensland are relatively high.

“In addition, China, which has been the predominant buyer of Australian sorghum in recent years, has a number of policy issues relating to Australia sorghum, which could affect demand.”