Leading French soy buying companies rated over disclosure

March 2017 saw France pass a new law related to due diligence, le devoir de vigilance. It requires large companies to disclose harms and lessen risks in their entire global supply chains. It has major implications for the environment, health, and human rights, said Mighty Earth.

On the law’s two year anniversary, the US campaigners joined NGOs, France Nature Environnement, a coalition of French grass-root environmental groups, and Sherpa in Paris to launch a report about supermarkets, food service groups, animal feed, and the meat and dairy industry’s compliance with the law.

The French government also adopted, in November 2018, a national strategy to combat imported deforestation, a policy that aims, by 2030, to put an end to deforestation caused by importing unsustainable forest and agricultural products.

Twenty of the largest soy-consuming companies in France such as Avril, which owns leading French feed company, Sanders, as well as others like Leclerc, Burger King, Sodexo were ranked in a scorecard, as part of that report. While some companies have taken initial steps to disclose their risk, such as Carrefour, a large number are failing to comply with the law, said the activists.

Background to scorecard

Etelle Higonnet, senior advisor, Mighty Earth, gave us the low down on the campaign.

She said, evidently, the original impetus for the report was this new piece of legislation, which Mighty Earth believes is a cut above similar laws elsewhere, such as the Modern Slavery Act in the UK and the Transparency in Supply Chains Act in California. It is quite specific on responsibility, and obliges companies to identify, mitigate and compensate for the harms in their supply chain, all the way down.

Prior to the legislation being enacted, the US campaigners met up with the French groups behind it, the advocates and champions on the civil society front who were mobilizing parliamentarians and engaging with the media.

Sanders and Avril have both signed up to the Duralim Charter, a collective approach in France aimed at improving the sustainability of livestock feeds. Terrena is also a member of that platform as is Carrefour, Casino, and McDonalds. All the stakeholders in Duralim have made pledges to work towards 100% sustainable raw materials by 2025, including a commitment on zero deforestation.

"It became obvious that, maybe, they were not equipped, on their own, to carry out the work needed to hold companies accountable to that law as they don’t do the kind of field investigations that would reveal the supply chain problems the law is designed to fix. So we started a dialogue to see how we could complement each other's work.”

On that basis, Mighty Earth joined up with France Nature Environnement and Sherpa to act. “We decided to bite the bullet and produce a report together to try and make this law a reality, because a law is only as good as its implementation.”

Why was soy the test case commodity?

Soy was the commodity chosen for the first case study in relation to industry compliance with the law due to what appeared to be a huge awareness gap in the French retail and food service sectors, in particular, on soy for use in animal feed as being a major driver of deforestation in Latin America, she explained.

“We are thinking about doing further thematic reports on major French companies that use rubber failing to adhere to the law, and likewise for French chocolate companies when it comes to the cocoa supply chain, and, again, similar action in relation to users of palm oil.”

Methodology

The process of compiling the ranking system involved the campaigners scanning all the published information on each company's soy supply chain and sending the firms multiple waves of questionnaires, with extensive follow up afterwards.

There were players more receptive and quicker to respond that others, said Higonnet.

“Some were engaged, others totally disengaged. However, the final result is that none of them are really doing what they are supposed to do [as per the due diligence law].

“If you don’t accept your problems, you can’t accept solutions. There are a bunch of solutions. Signing the Cerrado Manifesto couldn’t be easier, a lot of companies didn’t even do that; the New York Declaration on Forests is another path, you can support the Soy Moratorium, or you can use the G4 [guidelines on disclosure]. Such approaches signal to the soy farmers and the governments in producer countries that there is an appetite for change.

“There are all sort of ways to get to Rome. We were trying to be agnostic, to be flexible, but a lot of people didn’t get on the path at all, let alone the highway.”

Ultimately, the campaigners are urging companies to suspend non-compliant suppliers or, at least, give them a timetable regarding suspension to encourage them to get their house in order on supply chain problems.

“Companies need to do the right thing, even it is hard. It would be so much better if the entire French industry banded together and did it all at once, in a coordinated fashion, and say they are not sourcing soy any more from the bad suppliers.”

Weakness in the law

When asked whether companies would feel the brunt of le devoir de vigilance eventually if they don’t act, she said while the legislation is robust, the removal of an actual monetary amount, in relation to the financial penalties for breach of the regulation, might render the law too weak to act as a deterrent.

“It’s a brand new law, it has been approved by the highest courts in France. The court ruled that it is constitutional but they took out the specific monetary amount [in terms of the financial penalties to be imposed] and said that should be determined by a judge on a case by case basis.”

Wider impact

The ranking of companies on compliance with the legislation, though, would seem to have had some impact in France. The scorecard has been covered in some mainstream media outlets and was mentioned during a parliamentary session.

“We also got overwhelming response from companies to a webinar we ran with a cross-commodity industry platform on compliance with the law, and there have been a lot of questions following up on that. We are looking at doing something similar with the Roundtable on Responsible Soy (RTRS) for their members, and we are getting deluged with requests for presentations from other industry platforms on the due diligence legislation, how companies can work themselves out of this hole.”

Notable engagement

Are there any companies doing well?

“Carrefour, among the French supermarkets, is unquestionably doing the most, but I think Casino really deserves credit for the effort it has made so far.”

And in terms of French food groups, Danone and Bel, have scored higher than other companies due to actions taken.

Others like Les Mousquetaires, a French retail group that includes Netto and Intermarché, are moving in the right direction, she indicated.

“We engaged with Système U last year. It is just starting to get on the escalator.”

On the feed manufacturing front, Avril/Sanders is one of the better performers, she added. Last year, we talked to Clément Tostivint, sustainable development manager, Avril, about what that business is doing to promote more sustainable soy supply chains.

“What I would like to do is to update the report, and give everybody another bite at the apple, give them another opportunity to show how they are performing better, and get that out before the end of the year," concluded Higonnet.

Reps for several of the scorecard companies contacted did not immediately respond to FeedNavigator's request for comment.

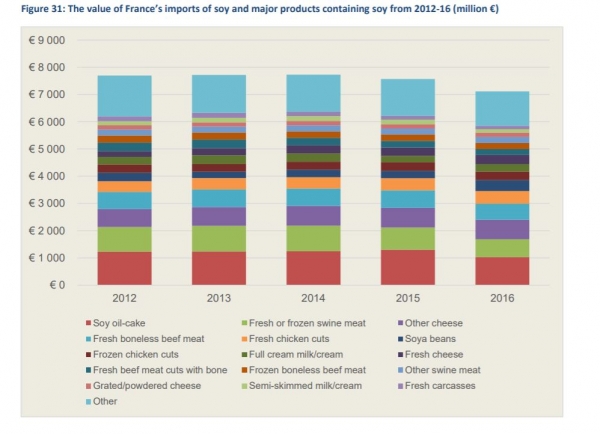

French soy imports

When adjusted for the soy content of imported products, France imported an average of 4.8m tons of soy each year between 2012-16 as soybeans, soy oil, soy meal, or as an ingredient or embedded within imported products, according to a WWF report.

In terms of monetary value, those imports totaled €7.6bn, each year, between 2012-16.