Rising disease pressures are challenging the global pork market: Rabobank

While China’s pork prices have started to move higher, production responses in the rest of the world appear cautious, said the Dutch bank.

Other factors, including disease management and weather, are hindering production in Europe and Brazil, the analysts said. Though the quarterly sees interesting developments on the feed commodity side in both regions.

The resumption of Sino-US trade negotiations is a positive development, however, implying a chance for China to review tariffs on US pork imports, concluded the report.

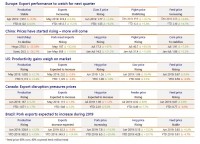

China: Tight supply, price hike

ASF continues to spread in China, with new cases mainly reported in South China. Live hog prices are finally moving higher, indicating tight supply. While fresh meat prices are moving, large inventories of frozen meat continue to pressure prices and weigh on market returns, reported the team.

Since mid-June, live hog prices moved higher, averaging above CNY 17/kg across the country. This is 15% higher than the previous month, and 40% higher than last year, said the Dutch research group.

The price increase reflects not only the supply shortage, but also producers holding back pigs to take advantage of anticipated price increases later in the year, said Rabobank, Pork meat prices have experienced even stronger growth, they noted.

New cases of ASF have been continuously reported, with the latest outbreaks concentrated in the south and southwest, documented the team. China Agriculture and Rural Affairs data showed the sow inventory dropped 26.7% YOY by the end of June, and hog inventory dropped 25.8%, said the analysts. Herd losses in specific regions are believed to be much worse, down by 40% to 60% since last August when the first case was reported, they added.

“We estimate the herd loss across the country is over 40% as of now. For the whole year, the herd loss could exceed 50% on a year-on-year basis. Driven by the prospects of strong prices in 2020, farmers and companies have started restocking in small scale in some regions, but very few of these efforts have been successful. However, we expect more companies will accelerate restocking by holding back gilts for reproduction.”

Europe: Export performance is positive

Summer heat is slowing production growth in Europe, contributing to better market prices, according to the pork quarterly. Exports have increased from most member states, mainly driven by stronger demand from China, wrote the team.

“Summer is having its full effect on European pork markets, with prices reaching seasonal highs. At the same time, export performance has been relatively positive, given the continent’s own ASF situation. Record temperatures in western Europe have led to lower pork production in recent weeks. Not only did the heat cause hogs to grow more slowly, but consumers were reluctant to purchase pork, according to industry sources.”

However, local feed commodity prices have been relatively unaffected by the heat wave in June. France, the largest wheat producer of the EU, is reporting an 8.5% YOY increase in soft wheat production for this year, reported the analysts.

While piglet prices in Europe have now started to trend downwards, they remain well above the five-year average, they said.

“According to industry sources, import demand from China has been slow in recent weeks but is expected to pick-up again over the next quarter. This should maintain upward pressure on prices for most of the next quarter and partially nullify the price declines usually seen in September.”

Despite strong prices, most European producers are not expanding their herds, added the analysts, citing recent figures published by German authorities showing a 2.9% YOY decline of total sows in the May 2019 livestock census. A similar trend was reported in Denmark, where the sow herd declined by 4.7% YOY in Q2 2019. Together, these countries account for 36% of the total EU sow herd.

ASF case in Slovakia

ASF in eastern Europe remains pressing, discouraging expansion, said Rabobank.

Meanwhile, the virus was confirmed in Slovakia for the first time, last week. The location of the case is near the border with Hungary, in the Kosice region.

It was confirmed on Wednesday at Slovakia's national reference laboratory, which reported the incident to the World Organization for Animal Health (OIE) on Thursday [July 25]. The OIE report said, to date, only one animal was confirmed as having the virus.

The origin of the outbreak is unknown. ASF was confirmed in neighboring Hungary for the first time in wild boar in April 2018.

All pigs within three kilometres (almost two miles) of the outbreak are to be culled, Slovakian authorities said, adding that they will establish a three-kilometre protection zone and a 10-kilometre surveillance zone.

US: Continued production growth in 2H 2019

Pork production in the US is expected to rise, driven by a large breeding herd and improvement in productivity, said Rabobank.

“While pork exports are struggling, the resolution of trade terms with Mexico and Canada should boost exports, and the resumption of trade negotiations with China is a positive. The labor shortage remains a key constraint in 2H 2019.”

Production gains due to favorable growing weather and better herd health contributed to a record breeding herd in a June report from the USDA, wrote the market specialists.

“Not only are weights higher (+2% YOY), but pigs saved per litter are also a record 3.5% higher. Weights will moderate with summer heat, but we are raising our estimate of 2H 2019 hog production to 5.3% to reflect improved productivity.

“Much like the gains we have seen after tightening up biosecurity in previous health challenges, the latest improvement in herd health appears sustainable and will compound the oversupply of pork expected to weigh on the market this fall.”

Export volumes have been hit by the ongoing trade dispute with China, but also due to rising competition for core markets in Japan and Mexico, said Rabobank. Pork exports to China have jumped to near record levels on a weekly basis but remain well below their potential given an ongoing 62% tariff, which makes US pork uncompetitive.

“We are hopeful that at least some of the tariffs could be lifted in 2H 2019, which would clear the way for larger exports,” said the analysts.

Brazil: Exports move to new highs

Pork exports out of Brazil are on the rise, driven by Chinese and Russian demand, although pig producers remain skeptical about whether this represents a structural return to growth, said the report.

Domestic pork prices in that market are increasing, as exports are outpacing production growth. If internal consumption picks up in the second half of the year, this will provide further support for prices, said the team.

Brazilian pork production costs have trended sideways, despite a sharp uptick in international corn prices, they added.

“This is because ideal planting and growing conditions have resulted in the Brazilian ‘safrinha’ corn crop reaching record levels, reducing feed costs. This, combined with the sharp increase in pig prices, has significantly improved producers´ margins,” commented the analysts.

Improved margins have led to a 3.5% YOY increase in pork production for the first quarter of the year. However, not all farmers are increasing their production, and many independent pig producers are still recovering from last year‘s low pork prices, which were largely caused by the Russian embargo, according to the publication.