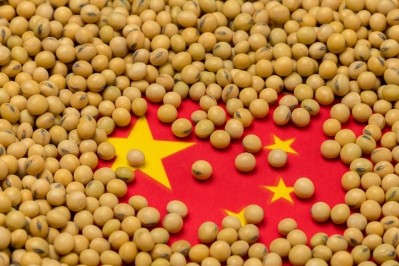

Chinese soybean demand outlook, feed milling operations resume

China's soybean demand is forecast to remain strong in the 2019-2020 marketing year from October–September despite concerns surrounding the coronavirus pandemic and African swine fever (ASF).

The global economy is forecast to shrink by 2.4% in 2020, and China's economic growth forecast has been slashed to 1.2% in 2020, down 1.7 percentage points from earlier estimates, noted S&P Global Ratings.

However, the market specialists write that Chinese demand for soybeans is not expected to bear the brunt of this economic deceleration. The Asian behemoth’s demand for soybeans in the 2019-2020 marketing year is predicted to hit 89m mt, up 8% year on year, according to the last WASDE report from the US Department of Agriculture

Platts forecasts that China will accelerate its beans purchases to cover for pandemic-led uncertainty hovering over port operations in South America, as trucking and port unions have threatened to shut operations due to COVID-19 quarantine and contagion concerns.

“While port authorities in Brazil and Argentina said they are maintaining normal operations, there is a high probability of union strikes and shutdowns if the death toll mounts, sources said. The coronavirus pandemic has already claimed over 2,500 lives in these two countries.”

The COVID-19 outbreak had caused bottlenecks at ports and work stoppages at crushing plants and feed factories in China, due to movement restrictions on labor and other government actions to contain the pandemic. Production at feed mills and farms was also interrupted due to movement restrictions on vehicles and personnel throughout the country.

However, China's Ministry of Agriculture and Rural Affairs (MARA) recently reported that 80% of feed mills had resumed normal operations.

Chinese hog inventory to rise

Despite low official reported cases of ASF and robust recovery efforts in the second half of 2019, overall swine production and slaughter in China will remain depressed in 2020, found a USDA outlook, published mid-April.

“Further complicating matters is the coronavirus outbreak in China, but it is likely that there will be sufficient market incentive and political stimulus to push forward with recovery efforts. As a result, the 2020 ending hog inventory is expected to increase slightly from 2019 as the decline bottoms out.”

Hog and sow inventory are both starting at low levels, having fallen 27 and 30% respectively from 2019’s starting inventory but year-end 2020 inventories are forecast to grow by 9%, forecast the USDA.

With low pork production in 2020 resulting in high pork prices, it anticipates that many Chinese consumers will seek out beef as an alternative protein.

“While elevated beef prices will spur some larger facilities to increase cattle production, most smaller facilities will be cautious in the face of uncertain pork prices and rising input costs. Overall, cattle ending inventories are expected to remain basically flat through 2020. The majority of increased beef demand will be satisfied by imports.”

The Chinese government will continue to use multiple market and policy interventions to try and stabilize prices. “As the pork supply remains tight through 2020, pork imports will increase to a record 3.9 MMT. However, China’s pork supply gap vastly outstrips available global supply, resulting in persistent high prices.”