Australia: Plan B needed to secure feed grains, looming Chinese tariff threat on country’s barley exports

A review of how best to import bulk grain was commissioned by the Meat and Livestock Australia and the Australian Lot Feeders Association (ALFA) along with Australia’s dairy, chicken and egg sectors.

The report, prepared by the Colere Group, looks at ways feed grain imports could offset a supply shortfall or excessive cost pressures resulting from drought.

Most cattle feedlots are on the east coast of Australia, while Western Australia is the largest grain producing state.

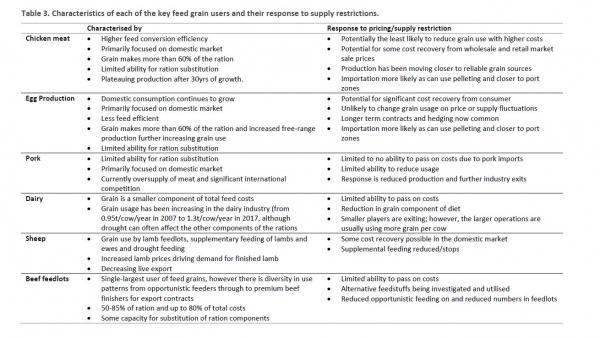

The animal industries on the east coast use 8.5-9 MMT feed grain annually, according to the publication. Grain-fed beef today represent 30-40% of total beef production in Australia.

Grain usage, though, has been increasing as well in the country’s dairy industry - from 0.95t/cow/year in 2007 to 1.3t/cow/year in 2017, found the report. The review also highlighted how grain makes up more than 60% of the broiler and layer bird ration.

Source: Review of grain devitalisation methods

Plan B required for grain and fodder security

Christian Mulders, CEO of ALFA, said the increasing climate variability in Australia meant a Plan B was vital for grain and fodder security.

“The grain and logistics industry should be commended for how well they’ve serviced the intensive animal industries during the most recent drought. However, we need to have technologies, systems and protocols tested and in place, ready to be implemented to keep our livestock industries in business.

“That’s why we’re exploring options and technologies to facilitate the safe importation of grain while ensuring Australia’s biosecurity reputation is protected.”

Soybean meal, which is a treated feed product, has regularly been imported into Australia.

However, historically, only very limited quantities of bulk grain have been imported into Australia, with such imports linked to severe drought conditions.

The pest and disease-free status of Australian production regions is a significant advantage both for grain production and access to export markets, and therefore they are closely protected.The importation of plant material of any type (into Australia, or even interstate) is considered a substantial threat to this status and is therefore protected through regulations anchored in legislation.

“One of the most heavily regulated areas is around the importation of bulk grains (unprocessed), which are required to be brought in through a full quarantine assessment process including proof that risks around pathogens, pests and weeds are being managed to the required standards.”

Source: Review of grain devitalisation methods

The review identified an opportunity for a multi-product processing facility for treating grain to be established within a port quarantine zone that could take advantage of the inland rail system that passes through regions where end-users are located.

“This would effectively take what was formerly a bulk grain importation issue and turn it into a plant-based stockfeed ingredient issue,” said Paul Meibusch, managing director, Colere Group.

The viability of such a facility would rely on having at least some of the capacity being utilized for more regular activities, such as the importation of whole soy, with the ability to expand when domestic supply conditions become tight, he added.

The authors concluded that to meet import biosecurity requirements, a combination of treatments and supply chain management factors are critical.

However, risk management feasibility alone doesn’t account for the commercial viability of such an undertaking, which is largely determined by the grain or stockfeed price differential.

The other key consideration is the commercial case for any domestic treatment facility that historically has not been required more than a few months each decade.

Key findings from the report

- The successful importation of bulk grain and plant-based stockfeed for the livestock industry is a process of risk management for best-practice of the eradication and sterilization of grain pests, pathogens and weed seeds.

- There’s an opportunity for a multi-product processing facility to be established in Australia and operated from within a seaport quarantine zone. To match the feed demands of the intensive livestock industries, the facility must be able to treat whole grain when it is imported, at a capacity of 10,000 tons per day.

- The research outlines the cost and effectiveness of several grain-sterilization techniques. The review found that an irradiation-based heat treatment, plus the fumigant, Ethanedinitrile, has the ability to meet the needs of grain importation as stand-alone treatments.

Source: Review of grain devitalisation methods

Grain growers react

Chief executive of Australian grain farmer sector representatives, Grain Growers Limited, David McKeon, warned the country's whole agriculture sector could suffer if grain imports allowed potentially catastrophic foreign pests or disease enter, writes Australian media outlet, ABC News.

"We have a large exportable (grain) surplus in Australia … and a fair amount of that goes into feed grains," he said.

At times of drought, he acknowledged, there have been regional grain shortages because most feedlots are on the east coast, while most grain is grown in Western Australia.

But he said grain growers and livestock producers should work together to lobby governments for better transport systems and grain market transparency to lowers costs across the entire sector.

Chinese tariffs on Australian barley

Meanwhile, a threat of major tariffs from China is looming for Australian barley shipments to China.

The Australian government said it’s been given until May 19 to deliver its final defense against a Chinese anti-dumping probe into the country’s exports of the cereal. Australian grain industry bodies, in a statement last weekend, said they believed China plans to impose tariffs of as high as 80% on the sector.