Pig feed set to overtake poultry feed in the EU compound feed sector rankings

EU compound feed production this year has been adversely affected by the spread of animal diseases such as African Swine Fever (ASF) and Avian Influenza (AI) and it has been indirectly impacted by the pandemic due to a shift in consumer demand for products of animal origin, says FEFAC.

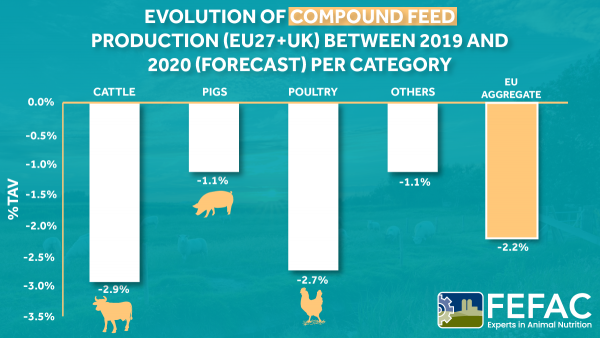

EU compound feed production (EU 27 + UK) for farmed animals in 2020 is estimated at 161,4m tons, a decrease of 2.2% compared to 2019, according to forecast data provided by FEFAC members.

Production decreases by species

All the main feed categories are set to see a drop in compound feed output.

Cattle feed production, which is estimated to decrease by 2.9% compared to the previous year, is suffering most from the COVID-19 measures applied during the first and second waves, in particular by the closure of the hotel, restaurant and catering sectors.

The decreased demand for more expensive cuts of meat, like veal, fresh meat and added valued dairy products, have impacted the whole supply chain.

Farmers have reduced usage of compound feed in their feed ratios, in order to reduce milk output and slowing growth of livestock. This was only partially compensated by rising demand in Eastern Europe where drought conditions led to poor forage harvests, according to the trade group.

EU pig feed production is forecast to see a drop of 1.1%.

The recent ASF outbreak in wild boars in Germany triggered a Chinese import ban on pig meat from that market. “Spain can only partially replace Germany in terms of pig meat exports to China, due to limited production capacity. A knock-on effect of the ban is that pig meat initially destined for export to China will stay in Europe, impacting pig feed production.”

On top of those challenges, some markets such as the Netherlands are also looking to reduce the size of their pig herds in order to lower agricultural environmental emissions, noted FEFAC.

Looking at the prospects for EU poultry feed production this year, a decrease of 2.7% is forecast, following several years of steady increases.

The poultry sector reacted to the COVID-19 lockdown measures launched in spring 2020 by reducing production, leading to significantly lower demand for poultry feed. Following a period of partial recovery during the summer months, a further decrease is expected by the end of the year, mainly in Romania, Ireland and Spain.

Moreover, the AI spread in several parts of Europe will hamper any recovery on the ground, reports FEFAC.