Feed volatility playing a role as production costs for UK pig producers surge to all-time highs

“It is typical for pig production to go through cycles of profitability and loss-making. However, it is unusual for margins to be this low for a prolonged period,” noted AHDB analyst Bethan Wilkins in a report.

The industry update highlights how record costs of production and lower pig prices than in 2020 resulted in producers losing, on average 28p/kg, or £24/pig (approx. US$33/pig), during the second quarter, following similar losses in Q1.

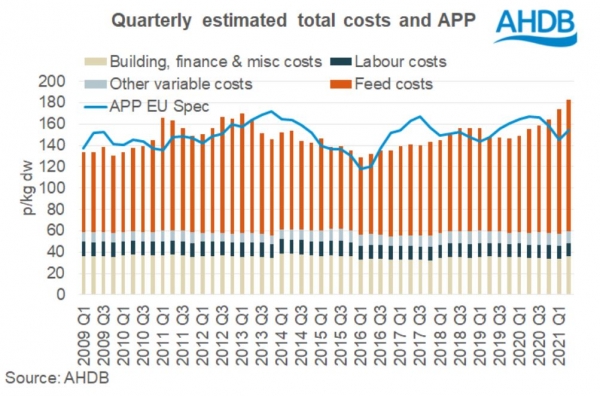

Estimated GB pig production costs in the second quarter of this year reached a record 182p/kg, according to the latest AHDB estimates. Compared to the same time last year, production costs were 27p/kg higher.

Rising feed costs a factor

The AHDB said rising feed costs are playing a role in the lack of profitability for UK pig producers: elevated global cereal and oilseed prices are negatively impacting the cost of pig feed, which now accounts for 67% of total pig production costs. However, both labor and fixed costs had also increased compared to the first quarter of 2021.

While pig prices have also increased compared to the start of the year - the APP [All Pig Price] averaged 154p/kg in Q2, 9p/kg more than during the first quarter - but when set against pig prices from last year, prices are 13p/kg lower.

"This means that, on average, pig producers remain in a significant loss-making situation," reported Wilkins.

There are no signs, currently, that the situation will improve during the current quarter, and, with some producers have already quit the industry, AHDB is forecasting a further contraction.

“Producers will have varying buying strategies to mitigate the volatility in feed markets and this will mean the level of exposure to rising feed costs may be less than our estimates indicate. We also include non-cash costs (such as depreciation and family labor) in the cost of production calculation, which do not affect the short-term cash flow of business.

"Nonetheless, the latest estimates paint a picture of finances that will be difficult for British pig producers to sustain for long,” she concluded.

As such, according to the AHDB analyst, the outlook for British pork producers remains difficult.