ASF, inflation and geopolitical issues could hinder growth in global pork market

Feed input prices have softened in some markets but are expected to stay relatively strong for the rest of this year. “This will lessen the pressure on producers to some extent. However, price volatility in grains and oilseeds will bring extra management risks and challenges,” noted Rabobank’s latest pork quarterly.

Mark your cards

In terms of what the industry should train its eyes on for the second half of 2022, the analysts say key should be a focus on the macroeconomic conditions that may impact currency and commodity values. Evidently, the grain and oilseed harvests in the EU, the US and China will be critical for how current feed price trends should play out.

Producers need to continue to be mindful of any new COVID-19 developments and restrictions in major producing and consuming countries as well as geopolitical issues that could impact trade policies and trade flows.

Disease threat

Challenges to growth will remain if African swine fever (ASF) continues to spread.

Since its first appearance in Germany in September 2020, ASF has spread west, with two recent cases reported on farms close to the French and Dutch borders. In Italy, too, the virus has traveled some 400km from the initial outbreak area.

“Most outbreaks in commercial herds happened in small-scale operations in Germany and Italy, with limited direct impact on production,” said Chenjun Pan, senior analyst, animal protein, Rabobank. “ASF-related trade restrictions, however, disrupt European markets, creating an oversupply of certain products and pressuring prices.”

In Asia, the disease continues to impact local production and prices, especially in Thailand, Vietnam, and the Philippines. Thailand’s pork supply could drop by over 35% in 2022 due to culling and liquidation activity, and pork retail prices have surged. The first global commercial ASF vaccine was approved in Vietnam in early June and is being rolled out across the country.

Meanwhile, ASF is still an issue in the Dominican Republic and Haiti, but remains contained. The North American industry is increasing testing and prevention efforts to limit the risk of introduction into local herds, reads the report.

Import demand from China

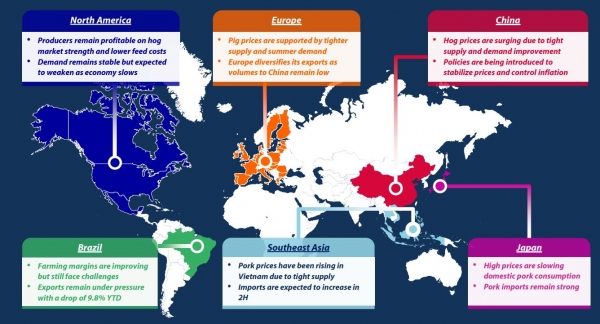

Global pork trade flows declined in the first half of 2022, mainly from weaker import demand from China, but also due to political, disease, and shipping issues, as well as the pork supply in exporting countries, found the analysts.

But global pork trade is expected to pick up in the second half of the year, largely due to the expected rise in import demand from China, according to the quarterly.

As COVID-19 restrictions in China ease and pork prices have been increasing, supporting imports. Still, despite an uptick in the second half of the year, the Rabobank team said they expect China’s imports to end 2022 down 25% to 35%. Other traditional importing countries, such as Japan, also expect imports to remain firm.

Demand remains strong in North America and is improving in the EU, a reflection of seasonal movement more than a structural change, said the swine market specialists. Japan, South Korea, and some other Asian countries expect weaker demand in the second half of 2022 due to rising inflation concerns, the slowing economy, and ongoing COVID-19 risks.

“China’s pork market is still subject to uncertainty around COVID-19 policy measures, but is looking more positive for the rest of the year. In Brazil, producers and processors are finding it difficult to pass additional costs on to consumers.”