Feed additives tracker: Fire at DSM factory in China, vitamin producer revenues down, lockdowns return

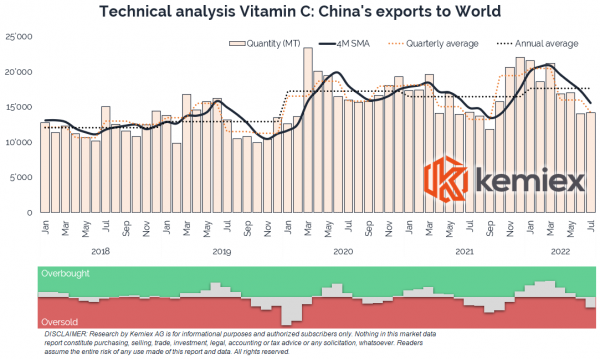

First Asian developments, and yesterday (September 1), a DSM factory in China's Jiangsu province caught fire. That plant produces vitamin C.

In an emailed statement to this publication, DSM said its on-site fire squad successfully extinguished a small fire at a cooling tower at DSM Jiangshan Pharmaceutical (Jiangsu) Co. Ltd

“The fire was under control in 15 minutes. No one was hurt and there was no risk to the surrounding area.

“The site was shut for routine annual maintenance during which no production was scheduled throughout August or September, so we do not foresee impact on future production or the supply of our products to customers.

“We are investigating the cause of the fire.”

Shutdowns, revenue woes

Looking to other feed additive suppliers in that market, and Swiss data provider, Kemiex, reports that vitamin B2 producer, Guangji Pharmaceutical, has extended its annual maintenance shutdown, until September 30, 2022.

The company said the delivery of imported equipment and spare parts was delayed and the scheduled maintenance work held up due to the extreme heat. The company confirmed, however, it has sufficient inventory of finished products to meet its contract requirements.

Tongliao Meihua Biotechnology Co Ltd has published an environmental impact report related to its investment in new production facilities. The new plant will be located in Mulitu Industrial Park, Tongliao city, in the eastern Inner Mongolia province, and expected capacity for that factory is 250,000 tons per annum of L-Threonine, noted Kemiex.

Revenue woes are a trend - ZMC, a China-based vitamin A supplier, saw its profits drop by 18% as it reported that revenue from that product halved in 1H 2022. Its vitamin E and levofloxacin sales were also down, while its operating costs have been increasing.

The company's portfolio includes vitamin E (DL-α-Tocopherol, vitamin E 50%), biotin, beta-carotene, coenzyme Q10, lutein, vitamin A and D3, as well as quinolone antibiotics and anti-malaria APIs.

Another vitamin supplier, Tianxin, also reported slightly weaker results in 1H 2022, said Kemiex.

Tianxin is a multi-vitamin producer for products such as vitamin B6, biotin, vitamin B1, folic acid, vitamin D3, ascorbyl palmitate, and others. Vitamin B1 income accounted for 37% of total income (US$ 66m, -3.8% YoY), while vitamin B6 made up 35% (US$ 63m, -11.4% YoY) of revenue. But biotin sales were US$16m, up +50% YoY.

Overall, it said profit margins for these products were down about 3-5% compared to 1H 2021. Export accounts for 64% of that producer’s income, domestic markets for 34%, added the feed and food additive market data experts.

And vitamin producer, Kingdomway, saw its profits drop by half in 1H 2022 as well.

It published its audited financial results for the first two quarters of 2022: operating income stood at US$ 231m, down -12% compared to 1H 2021, while operating costs rose +5.7% to US$ 131m. Net profits were around US$ 41m, dropping -46% YoY.

The company outlined how market prices for vitamin A and vitamin D3 have fallen sharply, while raw material costs were higher, and that procurement volumes and some distributors were affected by geopolitical conflicts.

On the asset trail

In company activity beyond Asia, Balchem Corporation has acquired Bergstrom Nutrition.

A specialty ingredients company focused on nutrition and health, this week saw Balchem announce the acquisition of Cardinal Associates Inc., operating as Bergstrom Nutrition, a manufacturer of Methylsulfonylmethane (MSM), and based in Vancouver, Washington.

MSM, said the parties, is a widely used nutritional ingredient with strong scientific evidence supporting its benefits for pet and human health and nutrition, and cosmetic focused markets.

Focusing on Europe and plastics and chemical distribution giant, Ravago, is to acquire Belgian additives specialist, Life Supplies. The deal is subject to approval by competition authorities.

“Life Supplies was owned by three entrepreneurs - Chantal Voets, Herman Meynaerts and Edward Verdult - who carried out a management buy-out in 2011. The three have many years of experience in the distribution of special chemical additives and additives for the food and animal feed market.

“Shortly after the buy-out, they bought the pet food division of the now listed chemical distributor Azelis,” commented Stefan Schmidinger, head of markets and strategy, Kemiex.

Ravago had a turnover of more than €13bn in 2021, and it acquired the distribution business of Indukern last year.

Electricity shortage eases

Turning again to China market issues, and Kemiex, citing the State Grid Sichuan Electric Power Company, reports that the capacity of electricity supply in Sichuan province has almost fully been restored, except for high-capacity enterprises, for which power consumption is gradually recovering.

In the last few weeks, Sichuan and nearby provinces had faced electricity shortages due to low water levels causing supply shortages for hydropower generation, and parallel high temperatures causing significant demand for air conditioning and electricity.

That development resulted in rationing, causing several industries in the region to reduce output.

Methionine producer, Hebang Bio, said the company's production base in Wutongqiao district, Leshan city, Sichuan province, was on standby for about 10 days amid extreme heat and the impact of limited power supply. The company expects a reduced output of soda ash, ammonium chloride, bisphosphonates, and methionine hydroxy analog (HB88 MHA).

China: COVID lockdowns return to key port cities

COVID-19 related lockdowns are ticking up in China again with neighborhoods in key port cities such as Shenzhen and Dalian forced back home this week, and mass testing underway at other important maritime gateways including Tianjin. So far, Kemiex sees no adverse impact on shipping.

China's factory orders and activity weaken in August

Meanwhile, China's official manufacturing purchasing manager index (PMI) published by the National Bureau of Statistics (NBS) was slightly higher at 49.4 in August from 49.0 in July but remains in contraction mode.

“The other major PMI index, Caixin’s PMI, fell to 49.5 in August from 50.4 in July in the first deterioration of operating conditions since May amid power cuts and major heatwaves across several regions.

“Lower prices for some raw materials, notably metals and chemicals, led to the first fall in input costs since May 2020. Though modest, the rate of reduction was the quickest seen since the start of 2016.

“The PMIs provides an early indication each month of economic activities in the Chinese manufacturing sector: above 50 means expansion, below 50 means contraction,” said Schmidinger.

Freight trends

Regarding sea freight trends, Kemiex finds that carriers under rising market pressure to cut rates.

The Shanghai Containerized Freight Index (SCFI) spot freight rates suffered its largest single week drop last week as carriers capitulated under rising market pressure to cut rates in order to protect market share, as per data from consultancy, Linerlytica.

“Supply chain bottlenecks are no longer providing price support as demand is clearly easing well ahead of the traditional start of the slack season in October.

“Port congestion eased at the end of last week, after rising to new highs in the US east coast and tropical storm Ma-Onin in South China also causing a minor surge.

“The strike at Felixstowe port has only had limited impact. Just a few containerships are currently in the UK port, with a few more ships scheduled to arrive after the end of the strike window.

“The barge services on the Rhine are improving slowly but steadily, and the German port workers union has reached agreement to avoid further strikes and disruptions,” said the Kemiex representative.

Copper sulfates: EU 27 imports from Russia down, Turkey up

Following the sanctions imposed on Russia by Western countries, EU 27 imports of copper sulphates from the country have dropped significantly, to about 400 metric tons in 2Q 2022, reported Kemiex

At the same time, imports of that product from Turkey have increased significantly, to around 3,900 tons. Poland is another important supplier within the EU, sourcing most raw materials from Uzbekistan.

Another worrying trend for the feed additive space, and other sectors, is the limited gas supply and rising prices.

Since the Russian invasion of Ukraine and the subsequent sanctions, gas supplies from Russia are significantly lower. Gas prices in Europe have risen by more than 2,800% in the past two years, added Kemiex.

EU approves METEX NOOVISTAGO's L-Glutamic acid, MSG

Regarding regulatory developments, the EU has authorized L-Glutamic acid and Monosodium glutamate (MSG, Monosodium L-glutamate monohydrate) produced by Corynebacterium glutamicum NITE BP-01681 as feed additives for all animal species. The raw materials are classified in the categories: nutritional additives and sensory additives.

The European Food Safety Authority (EFSA) concluded, in its scientific opinion from January 2022, that the additives are efficacious and safe for the target species, the consumer and environment.

The applicant for the market authorization was METEX NOOVISTAGO, formerly Ajinomoto Animal Nutrition Europe (AANE