Animal feed industry in England, Scotland and Wales hit by reduced demand

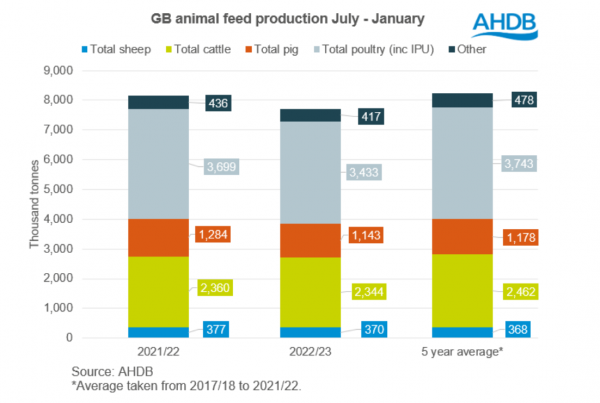

Yesterday saw AHDB release its animal feed production figures for July 2022 to January 2023 for GB, namely, England, Scotland, and Wales.

Unsurprisingly, it is the poultry and pig feed sectors that saw the biggest reductions in that period. Though, the analysts note all GB livestock sectors face challenges from rising feed and input costs to the impact of the cost-of-living crisis.

Pig feed still in the doldrums

The GB pig feed production season to date is down 11% from the same period in the year prior, and 3% lower than the previous five-year average production level.

Last year was one of the most challenging years for the GB pork sector, with negative margins leading to a significant drop in the breeding herd.

GB pig meat production is forecast to decline by up to 15% year on year in 2023, driven by a reduction in 'clean' pig kill in the first half of the year, following a significant drop in the breeding herd, according to the AHDB Agri-Market Outlook. Thus, the analysts expect reduced overall pig feed demand for the rest of the season.

However, they forecast a gradual recovery in the breeding herd, with numbers predicted to increase by 7,000 head between June last year through to June 2023.

Imports are expected to grow to match the gap left by reduced domestic supplies, while exports are projected to decline as available domestic supplies tighten. Domestic demand continues to ease, driven by the cost-of-living crisis reducing retail sales and eating-out demand, as per the data in the outlook.

Poultry feed output reflects cost and disease challenges

Total GB poultry feed production (including IPU) season to date is down 7% from last season and 8% lower than the previous five-year average.

“The poultry industry has been facing challenges of squeezed margins from high costs and the impacts of avian flu, which continue to create a challenging environment for the sector this season.”

Dairy demand remains robust

Looking to ruminants, total cattle feed production this season is down 1% from last season, and 5% down on the five-year average. “The reason for this reduction on the season is reduced production of calf feed, protein concentrates, and other concentrates/blends,” reported the AHDB team.

However, dairy compounds and blends are up marginally. “GB milk production is forecast to record marginal growth in 2023 in the region of 0.3%, therefore. we can expect this dairy demand to continue.”

GB beef production is expected to grow slightly (+0.6%) as well this year, due to higher cattle availability. “Despite some areas seeing poor forage quality due to the dry weather in some regions, with feed costs high, it may be that forage is maximized where possible.”