US soy crush market woes: ‘The current shrinking margins will test old and new plants’

Former Bunge procurement director, Gordon Denny, tells us his discussions with industry insiders reveal increasing pressure within the sector.

He anticipates that the lower processing margins will pause soy crush facility expansions in the US, while the closure of four to five older current plants is likely.

"The surplus of meal, coupled with high interest rates and significantly reduced margins, alongside rapid expansion, are all converging to confront processors with a stark reality."

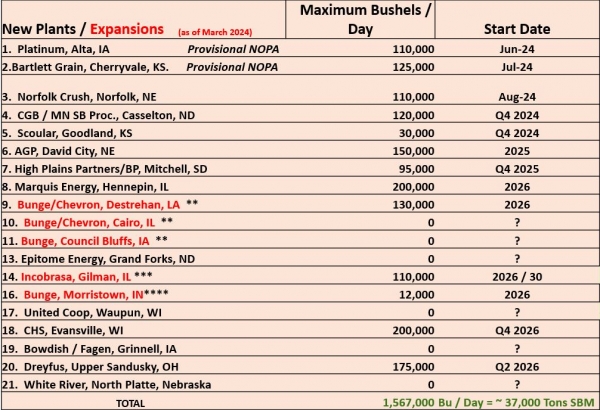

There will most likely be a 11 million metric ton increase in US soybean meal production over the next two to three years, reckons Denny, who has been tracking expansion developments over the past few years.

Industry voices speak out:

A chorus of concerns echoes through the corridors of soybean processing plants, notes Denny.

A. "The US is losing the feedstock battle!"

B. "The current and future labor shortage is hurting our safety, productivity, quality, and run time."

C. "The current shrinking margins will test old and new plants. I hope the new guys have enough capital to offset low margins, high depreciation, lower run rates."

D. "I spend way too much time in meetings discussing GREET, LCFS, CARB, RVOs, CI Score, Argonne Nat instead of doing the right thing in the market."

E. "How can we let Brazilian tallow from cattle feeding off deforested land, and Chinese used cooking oil (UCO) into the US to meet subsidies and mandates, while US soybean oil isn’t competitive on price or CI score?"

Terms explained

- The Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) model is a lifecycle analysis tool. It is widely used to assess the energy and environmental impacts of various transportation fuels and vehicle technologies throughout their entire lifecycle.

- LCFS stands for Low Carbon Fuel Standard. It is a regulatory program that aims to reduce the carbon intensity of transportation fuels to combat climate change.

- CARB stands for the California Air Resources Board. It is a regulatory agency in the state of California responsible for setting air quality standards and implementing programs to reduce air pollution, including the LCFS.

- RVO stands for Renewable Volume Obligation. In the context of biofuels, RVOs are annual targets set by the Environmental Protection Agency (EPA) in the US under the Renewable Fuel Standard (RFS) program. These targets specify the volume of renewable fuels, such as ethanol and biodiesel, that must be blended into the nation's transportation fuel supply.

- CI Score refers to the Carbon Intensity Score. It is a measure of the amount of carbon dioxide equivalent emissions produced per unit of energy or fuel produced, typically expressed in grams of CO2 equivalent per megajoule (g CO2e/MJ). Lower CI scores indicate lower emissions intensity and are often associated with cleaner, more environmentally friendly fuels.

- Argonne Nat refers to the Argonne National Laboratory, a multidisciplinary science and engineering research center located in Lemont, Illinois. It is one of the largest national laboratories of the UD Department of Energy (DOE) and is known for its research in various fields, including energy, environmental science, and transportation.

Market downturn

The once buoyant soybean market has hit rock bottom, with current spot cash crush prices sinking to as low as $0.65 per bushel in some locations, continues the consultant. Finding buyers for soybean oil has become increasingly challenging, while meal values and prices remain weak, he reports.

“The situation has deteriorated rapidly, with US soybean oil now trading at a staggering -$0.05 under the Chicago Mercantile Exchange (CME), a far cry from the +$0.20 per pound premium seen just months ago.”

If new US soybean processing plants, scheduled to start operations soon, lack any oil or meal sales agreements it would mean these facilities would have to enter the market without prearranged contracts, which could potentially worsen the current surplus and drive prices down further, adds Denny.

Rising competition and international dynamics

Adding insult to injury, the rise of competing oils, such as UCO, canola oil, lard, and tallow, has flooded the market, exacerbating the woes of US soybean processors, says Denny.

Meanwhile, Canadian canola crush is on the ascent, with plants operating at a 95.3% capacity utilization rate and new facilities slated to come online, further intensifying competition, he remarks.

“Canadian canola crush is up 10% year-on-year. Canola is a 42% oil crop, comes to the US duty free, meets all the standards for renewable diesel, and has a lower CI score than soybean oil. A new plant will start early 2025, and another in 2026.”

The findings of a recent report from CoBank are somewhat in line with Denny's views.

Authors, Brian Earnest, Tanner Ehmke, and Jacqui Fatka remarked that the record crush margins of the last two to three years are likely in the rearview mirror with low to moderate margins expected for the near term until policy and industry production targets align on volume levels for renewable diesel.

"This is raising the margin risk on newly built plants with high breakeven costs of production, or destination plants with higher costs of acquiring and transporting soybeans."

Their report sees that:

- Balance sheets of US crushers are strong following multiple years of record crush margins.

- The current downturn in crush margins will not result in rationalization of assets in the near term.

- Rising demand for soybean oil to meet renewable diesel demand will support soybean oil prices long-term.

- US feed demand for soybean meal will increase marginally, requiring the US to compete in the export market.

- Soybean basis will tighten in local areas, compressing crush margins for some plants.

- Risk of prolonged stress on soybean meal prices will pressure margins, potentially resulting in loss of crush capacity in Argentina, where the new Argentine government has proposed higher export taxes on soybean meal.

- In the long term, the risk of overbuilding US soybean crush capacity by undisciplined capital could result in declining margins and the eventual consolidation of weaker players.

Navigating a murky regulatory landscape

Amidst this economic turmoil, processors and farmers are left grappling with illogical, political, and inconsistent regulations governing RD, sustainable aviation fuel (SAF), and CI scores, claims Denny.

These regulatory hurdles threaten to compound the challenges faced by US farmers and processors, casting a pall over the industry's outlook for the coming years, he maintains.

In a world where big oil wields considerable influence, there is an urgent need for fair and equitable policies that safeguard the interests of all stakeholders, he argues.

"The US is producing and exporting record amounts of crude oil and LNG. Meanwhile, global coal consumption is soaring. Yet, we find ourselves embroiled in debates over the allowable soybean oil CI score within a GREET model."