Swine and poultry markets deliver for Chr. Hansen

However, the Danish company noted the difficult market conditions for cattle farmers in the US; it said those challenges resulted in a decline in its probiotics for cattle business.

The human health business delivered “good” growth, and plant health performed well.

Organic growth for its health and nutrition division overall was 8%, and, adjusting for a negative currency impact of 5%, that corresponded to a revenue increase of 3% to €231m, compared to the year prior, it said.

The earnings before interest and taxes (EBIT) for its health and nutrition business amounted to €72m, compared to €66m in 2016/17; the EBIT margin for the division was 31%, up 1.8%-points on the previous year, it added.

Trends

Looking at animal production trends generally throughout the year, Chr. Hansen said:

“In 2017/18, the markets for microbial solutions in the agricultural industry were impacted by fluctuating meat, milk and feed prices. In Europe, this was to some extent driven by the unusually hot weather over the summer, and in the US, low milk prices created a difficult environment for dairy farmers.

“The poultry market continued to be driven by an increasing demand for antibiotic free meat, which creates good conditions for probiotics. Competition is still increasing slightly in parts of the market.”

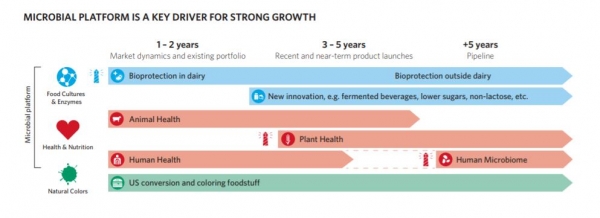

Chr. Hansen’s health and nutrition division produces and sells products for the dietary supplement, over-the-counter pharmaceutical, infant formula, feed and plant protection industries.

In terms of its microbial concepts for feed and silage, it sees growth opportunities in the fact a rapidly increasing world population is spurring a need to increase productivity in the agriculture industry, with pressure also growing on the livestock industry worldwide to reduce the use of antibiotic growth promoters (AGPs).

The company stressed, though, that the primary near term focus for its animal health business is to further strengthen the global route-to-market.

Group results

Adjusting for a negative currency impact of 6%, the Chr Hansen group's overall revenue increased 3% to €1.097bn. Commenting on the FY results, the new CEO of Chr. Hansen, Mauricio Graber, said:

“2017/18 was another good year for Chr. Hansen, and we finished strongly in Q4 driven by food cultures and enzymes and health and nutrition. We achieved all the overall financial targets that we set at the beginning of the year, in spite of currency headwinds impacting both revenues and earnings, with organic growth reaching 9%, EBIT margin before special items increasing to 29.2%, and free cash flow before special items and acquisitions increasing by 4% to €196m.

“For the full year, food cultures and enzymes delivered strong growth organic of 12%, performing well above the long-term ambition of growing 7-8% per year, while health and nutrition and natural colors delivered moderate growth and grew by 8% and 5%, respectively.”