Experts weigh up likely impact of German ASF case on wider market

NPA chief executive Zoe Davies said, however, that the German authorities were well prepared to manage the spread of the virus in their country and keep it out of domestic pigs.

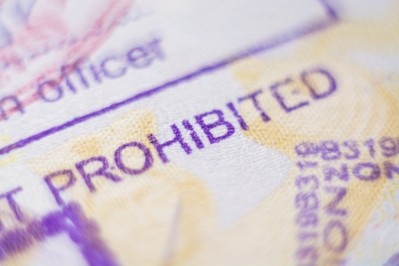

“We await to see what the trade implications will be, but there is the potential for export restrictions to be put in place," said Davis.

Germany is one of the biggest pork exporters in the world and producers need to be aware that this could result in downward market pressure if surplus product that can no longer be exported is re-directed onto the EU market, she stressed.

"There will also be export opportunities for those countries, like the UK that can export to China, so this will hopefully lessen the blow, but the same cannot be said for the cull sow market which is already in the doldrums,” said the NPA executive.

Potential ban from China?

The AHDB said that it remains to be seen whether China will follow its usual approach and place a total ban on all German pork imports.

“Germany has previously been hopeful that it might be able to achieve a regional agreement with China, whereby unaffected areas could still trade,” said Bethan Wilkins, AHDB senior analyst, red meat, in a note released yesterday on the implications of the confirmation of the ASF case in a wild boar in Germany.

She previously reported on how the loss of German pork exports to China, and a number of other key markets, could effectively 'trap' a large volume of pork on the EU (+UK) market. Prices would then be expected to come under pressure.

“However, in the past 18 months, the EU has been sending so much pork to China, that even if Germany did lose much of its export market, the volume that would become available for consumption within the EU would not be large by historic standards. This is because this is pork that has been exported instead of being consumed in Europe. It is not 'extra' pork that the EU market would have to absorb, but rather volume that the EU market had been consuming until recently.”

EU pig meat production has been lower so far this year, influenced by Covid-19 linked market disruption, but is expected to be broadly stable in 2020 overall, she added.

Ongoing strong demand from China has continued to draw pork from the EU market, and for January-May, exports were up by 16% (+260,000 tons carcass weight equivalent), said Wilkins.