Feed demand in China to rise based on recovery in pig herd

“Poultry and ruminant feed demand are [also] expected to increase slightly,” forecast the authors of a new USDA FAS report on the Chinese feed market.

Rice substitution for corn in feed rations is also expected because of rice’s price advantages over corn and other corn substitutes.

Recent dip in swine feed output

Data from China’s feed industry association data shows that total industrial feed production for MY2021/22 was 0.6% higher than MY2020/21.

From October through to December 2021, the larger feed output though was offset by a reduction of total feed production of 3.2% later on - in January through May 2022. In those five months, swine feed was down by 5.7%, layer feed down by 3.5%, and broiler feed down by 4.8% from the same period in 2021.

Swine feed production in both April and May this year saw a plunge of around 15% compared to last year. “Industry contacts believe the lower swine feed production in April was due to reduced pig slaughtering weight, lower pig inventory and COVID-19 lockdowns.”

Expanded herds on the horizon

But that trend looks set to be reversed.

Statistics from China’s ministry of agriculture and rural affairs (MARA), released at the end of April 2022, placed the sow herd at 41.77 million - that represents a 10% drop from the 45.64 million head recorded at the end of June 2021.

But if breeding profits continue to improve, restocking may begin in July, leading to hog slaughter increases starting in the first quarter of 2023, reckons the USDA team.

Looking to the poultry industry in China, after declining in 2021, broiler production is forecast to rebound by 2% to 14.3 million MT in 2022 as large-scale broiler producers utilize expanded production facilities, noted the report.

Grain market outlook

According to MARA data, corn production in China for MY2022/23 is forecast at 270 MMT, 1% lower than last year, due to lower planted area.

The reduced corn area is the result of farmers reacting to the higher soybean subsidies vis-à-vis corn, which increases corn-soybean intercropping. The soybean subsidy this year was three times that for corn.

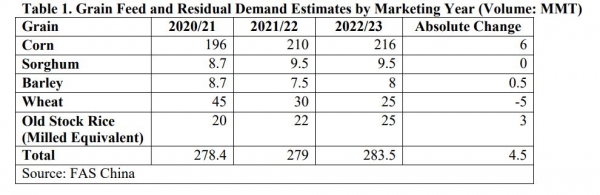

The forecast for MY 2022/23 feed and residual use is 216 MMT, 2 MMT more than USDA's June estimate, as feed mills switch back to corn rations.

Many feed mills have reportedly stopped substituting wheat for corn, with the China Feed Industry Association noting that corn usage in compound feed increased from 35.3 to 40.8% during the first four months of this year.

“Since the beginning of the calendar year 2022, corn prices have remained stable but at high levels. The industry consensus is that the gap between China's corn demand and supply will persist for the foreseeable future. The availability of substitutes and imports is an important determinant of corn feed consumption.”

China looks to US and Brazil for corn

The USDA FAS team forecast MY 2022/23 corn imports at 18 MMT, 2 MMT lower than its prior estimate and the same as USDA's official estimate.

China has turned to the US to close its 2-4 MMT corn supply gap in MY2021/22 due to the war in Ukraine.

“In April alone, China purchased 4.5 MMT of US corn with more than 2.6 MMT for MY2021/22 and close to 2 MMT for MY2022/23. There were no big purchases in May mainly due to the depreciation of the RMB against the US dollar.

“However, in recent weeks, the exchange rate has become more favorable. The after-tax landed prices of US corn to southern Chinese ports returned to around RMB 3,000 per ton in June from RMB 3,200 per ton in May. It's projected over 1.3 MMT of US corn will arrive in China in June, mainly in Zhejiang, Guangdong, and Shandong provinces.”

Notably, in April, China and Brazil signed an updated protocol on phytosanitary requirements for exporting Brazilian corn to China.

“Industry sources speculate that China might have already purchased between 250,000 to 400,000 tons of corn from Brazil. Brazilian corn's after-tariff price is RMB 200 per ton lower than US corn. It will take two to three months for corn from Brazil to reach ports in China, and it might go into the national reserves instead of being distributed to the market.

“In the past, most Chinese enterprises moved away from Brazilian corn due to the extended shipping times and high freight costs. The lack of relevant government approvals for genetically modified corn also added to the difficulty of importing from Brazil.”

Sorghum is pricey

The report sees sorghum feed and residual use in China at 9.5 MMT in MY 2022/23 and 9.5 MMT in MY2021/22, a reduction of 1 MMT, said the authors, as current sorghum prices at Chinese ports are quoted at more than $451 (RMB 3,000) per ton.

“US sorghum's quotes have increased from $417 (RMB 2,770) per ton in February to $459 (RMB 3,050) per ton in June.

“Argentina's sorghum quotes have also jumped from $391 (RMB 2,600) per ton in February to $ 436 (RMB 2,900) per ton in June.

“Although Argentine and Australian sorghum prices are more competitive, their export potential to China is limited.”

Lower barley inclusion in feed likely

Barley feed and residual use in China for MY 2022/23 is adjusted to 7.5 MMT, about 1.6 MMT lower than the USDA FAS team’s April estimate. This again is down to prices with barley at ports quoted at $436 (RMB 2,900) per ton, meaning the crop is losing its previous price advantage over corn.

“Barley is a good substitute for corn for its low toxin and rich fiber. But barley has only 85-90% of the nutrition value of corn, so mills will only use barley in hog feed when its price is 10-15% lower than corn.”

China's January to May barley imports contracted by 28% to 3.3 MMT year-over-year.

Argentina, Canada, and France are the leading barley suppliers to China, accounting for 85% of the import market.

Small percentage of wheat going to feed mills

Wheat production in China in 2022/23 is forecast at 135 MMT.

But skyrocketing wheat prices have prevented feed mills from replacing corn with wheat this year.

“MY2022/23 wheat imports are forecast at 9 MMT, 500,000 tons lower than USDA's June estimates due to high prices. International wheat prices have soared by over 40% in the past four months.

“Because of the COVID pandemic, the war in Ukraine, export bans, higher freight and insurance costs, inflation, and speculation, international wheat prices are expected to remain high. In the first five months of 2022, wheat imports were down by 4.1% year-over-year.

“Imported prices of wheat landed in May were lower than domestic corn prices. But most of the imported wheat is destined for flour production, and only a small percentage goes to feed mills.”

Post's rice import estimate for MY 2022/23 is 6.0 MMT due to animal feed demand.