Agri-commodity market trends

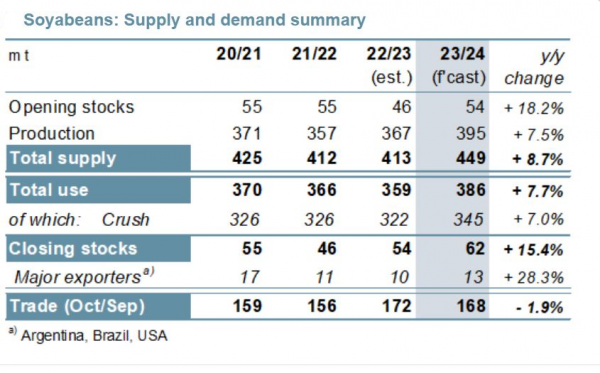

IGC forecasts 7% jump in global soybean output

And the Council predicts that global soybean consumption will jump 8% y/y as well.

Led by expectations for a bumper world corn harvest, the IGC sees total grain production rising by 1% in 2023-24.

Although wheat output will be smaller y/y, the crop is still expected to be the second largest on record. Higher feed demand is expected.

“Changes from October include an upgraded outlook for maize [corn], tied mainly to reports of better than expected US yields, as well as an increased wheat figure, reflecting the latest updates for Ukraine, Russia and Turkey.”

Grains: Weather remains a watchpoint

Meanwhile in its latest review of the agri-commodity sector, the AHDB observes that grain markets were pressured towards the end of last week due to an improved weather outlook in Brazil.

Weather over the coming months will remain a watchpoint, said the analysts.

“Forecasts of much needed rain in Brazil over the next seven days is expected to ease concerns over the area of the Safrinha corn crop due to be planted early next year.”

The Safrinha crop follows the soybean harvest and comprises roughly three-quarters of Brazil’s total corn production.

Looking to the Black Sea region, and the AHDB report found that despite the expiration of the UN-brokered Black Sea grain deal in July, there is a continual flow of Ukrainian grain exports via sea lanes. Last Friday, the Interfax-Ukraine news agency reported that an estimated 151 ships have used the new ‘humanitarian corridor’ since it was set up in August.

“With focus beginning to turn to Northern Hemisphere new crops, officials suggest Ukraine could potentially harvest between 18 Mt to 20 Mt of winter wheat in harvest 2024. This is in comparison to the 22.2 Mt harvested in 2023.”

Elsewhere in Europe, wet weather in France is delaying planting progression of winter wheat, reads the AHDB outlook. On Friday, FranceAgiMer reported that 71% of the expected soft wheat area had been planted by November 13 with it stating that the continuous rainfall over the past month would likely lead to a drop in area and damaged yields. “European plantings and crop conditions over the next few weeks will be a key factor to watch.”

Oilseeds: Dryness in Brazil, rain in Argentina

The north of Brazil is experiencing dryness, a typical impact of El Niño weather events, said the UK analysts.

“The Brazilian soybean crop is expected to be a record currently, however, the dry weather in the north means some forecasts have been cut. The consultancy AgRural lowered its forecast for 2023-24 to 163.5 Mt, down from October’s forecast of 164.6 Mt and announced that new cuts were possible at the end of this month depending on the weather. It is also reported that, in parts of Mato Grosso, some farmers have turned from soybeans to alternative crops like cotton.”

In Argentina, it’s the opposite. Recent rainfall across the north of the country means the soybean area is increasing. “The Buenos Aires Grain Exchange last Thursday increased its soybean area projection to 17.3 Mha, up from the previous 17.1 Mha forecast.”

Largest US soybean crush on record

Demand is strong for soybeans in the US, according to the AHDB review. The US National Oilseed Processors Association (NOPA) estimated October soybean crush at 5.2 Mt, the largest crush on record.

“This is up 14.7% from September, and up 2.9% year-on-year. The end of month US soy oil stocks also fell to the lowest point in nearly nine years. Soaring demand for feedstocks for biofuels has ensued a large expansion in crushing capacity.”

Furthermore, there was large export demand for US soybeans, remarked the UK grain and oilseed market specialists. The USDA reported sales (to week ending November 9) at 3.9 Mt, this the highest weekly volumes sales since 2012, with a surge in Chinese buying.

Rapeseed focus

Soybeans are largely going to drive the sentiment of oilseed markets, including rapeseed, going into 2024 and longer-term pressure is expected, they added.

However, as the focus turns towards rapeseed areas being planted for harvest 2024, initial estimates suggest area reductions in the EU.

Germany’s winter rapeseed area is expected to fall 4-7% from 2023, to an estimated 1.09 – 1.13 Mha.

“A combination of market prices and challenging weather conditions have contributed to the reduction in area. A rainy summer prevented an early start to planting, followed by a very dry autumn,” commented the AHDB team.